Are you a business owner worried about ACH fraud in 2024?

As an expert in payments, I understand the challenges of protecting your business from fraud. That’s why I wrote this essential guide for businesses on preventing ACH fraud. This comprehensive guide will help you identify what kind of attacks are most likely to succeed and how to best protect yourself against them. It also includes practical advice based on my years of experience working at a payment processor.

With this guide, you can keep your business safe while continuing to serve customers quickly and efficiently. You can easily identify potential threats and learn practical strategies that make it difficult for criminals to steal from you or your customers with ACH debit transactions. Armed with this knowledge, take preventive action before any fraudulent attempts occur!

Read my blog post today and find out more about protecting your business from ACH Fraud now!

ACH fraud is a growing concern in our increasingly digital world, with cybercriminals targeting both individuals and businesses.

Key takeaways include the importance of strong, unique passwords, two-factor authentication, regular monitoring of accounts, and educating oneself about potential phishing scams.

Additional strategies like implementing an ACH block, verifying payment instructions, and having a well-designed fraud prevention plan are crucial for businesses.

The goal is to stay vigilant, be proactive, and ensure you’re not easy targets for these cyber threats.

This site is supported by its readers. If you purchase through a link on my site, I may earn a commission. For more information see my Disclosure Policy

What is ACH Fraud?

ACH fraud, a prevalent form of financial crime, can have severe implications for businesses.

This type of fraud occurs within the Automated Clearing House ACH network, an electronic system used to process transactions between banks and credit unions in the United States.

Fraudsters seek opportunities to exploit vulnerabilities in this system, often leading to significant fraud losses.

In fact, according to the Association of Financial Professionals, in a study underwritten by JP Morgan, ACH fraud is on the rise, increasing from 34% of respondents reporting ACH payments fraud in 2020 to 37% in 2021.

In essence, ACH fraud happens when unauthorized individuals gain access to confidential banking information such as bank account passwords or originating company ID details. They then use this data unlawfully to initiate incoming ACH debits from victims’ accounts, causing huge financial damage.

It involves everything from identity theft and phishing schemes to more sophisticated methods like creating fraudulent rings where innocent people unknowingly move funds on behalf of criminals.

As we dig deeper into understanding different types, remember: knowledge is power. It’s crucial for authorized ACH originators (that’d be YOU) who regularly process ACH transactions to be aware so they may avoid becoming victims themselves.

Next up? We’ll explore some common forms ACH fraud takes…so stay tuned.

Common Types of ACH Fraud

This type of fraud typically involves unauthorized funds transfer, identity theft, or phishing schemes aimed at stealing bank account passwords.

Unauthorized Transfer

In this common scam, criminals access the company’s financial information and initiate unauthorized incoming ACH debits from your business accounts.

Payroll Diversion

Fraudsters seek out employees’ login credentials through deceptive emails or phone calls, then reroute their paychecks into other accounts — an increasingly complex form of ACH fraud that is difficult to detect until it’s too late.

Vendor Impersonation

Criminals pose as legitimate vendors requesting payment via ACH transfers instead of checks. This technique involves impersonating authorized ACH originators using their originating company ID. You can unknowingly move funds directly into fraudulent bank accounts — another example where early detection of fraudulent activity can prevent significant losses.

How to Detect ACH Fraud

Detecting ACH fraud within a business environment requires vigilance, robust systems, and a well-trained workforce. Here are some key indicators and methods you should be aware of:

- Unusual or Unexpected Transactions: Any transactions that don’t align with the usual business patterns should be investigated immediately. This includes unexpected withdrawals, transfers to unfamiliar accounts, or transactions occurring at odd times.

- Changes in Vendor Details: If you notice sudden changes in your vendor’s payment details, it could be a sign of invoice or payment fraud. Always confirm any changes directly with your vendors before making payments.

- Unexpected Balance Alerts: If your business receives alerts about balance thresholds being breached unexpectedly, it’s critical to review your account activity closely.

- Suspicious Emails or Calls: Be alert to unsolicited communication asking for sensitive information or urging immediate action. These could be phishing attempts to gain access to your account.

- Inconsistent Transaction Volume or Frequency: A sudden increase in transaction size, frequency, or regularity can indicate potential fraud.

- Employee Training: Ensure all employees are trained to spot the signs of a fraudulent ACH transaction. This includes understanding typical scam tactics, recognizing phishing attempts, and knowing what actions to take if they suspect fraud.

- Regular Audits: Regular financial audits and reviews of your business accounts can help detect discrepancies or unusual activity that might go unnoticed.

- Advanced Fraud Detection Tools: Many financial institutions provide tools to help businesses identify and respond to fraudulent activity. These can include machine learning algorithms that detect unusual patterns and real-time alerts for suspicious activity.

By staying vigilant and implementing these practices, you can significantly enhance their ability to detect ACH fraud, minimizing the potential impact on their operations.

Best Practices for Preventing ACH Fraud

ACH fraud prevention is crucial to safeguard your business from potential financial losses.

NACHA, the body governing the ACH network, provides guidelines and measures to prevent such fraud.

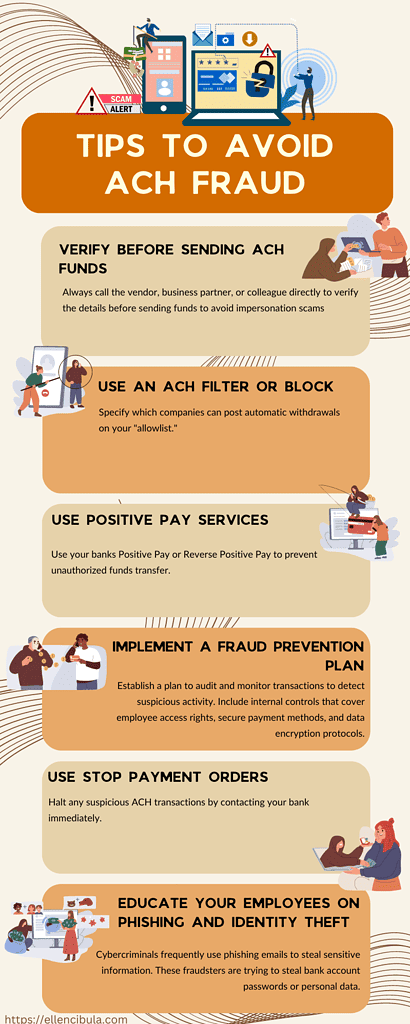

- Verify Before Sending Funds: Always call the vendor, business partner, or colleague directly to verify the details before sending any funds. Maintain current vendor information with everyone you do business with. This practice helps avoid falling victim to impersonation scams.

- Use an ACH Filter or Block: Implementing a block on all accounts is one of the easiest ways to prevent unauthorized ACH transactions. These tools prevent unknown entities from pulling money from your bank accounts without authorization. They allow you to specify which companies can post automatic withdrawals via a list known as an ‘originating company id’ allowlist.

- Educate Account Holders: Inform account holders about the dangers of ACH fraud and immediately notify them of any suspicious account activity.

- Use Positive Pay Services: Banks and other financial institutions offer positive pay or its variant, reverse positive pay, providing additional security against unauthorized funds transfer. These tools allow businesses to review all outgoing payments before they’re finalized.

- Implement a Fraud Prevention Plan: Establish a well-designed fraud prevention plan involving auditing and monitoring transactions to detect suspicious activity. This plan should also include setting up internal controls to prevent fraud, covering employee access rights, secure payment methods, and data encryption protocols.

- Use Stop Payment Orders: Halt any suspicious ACH transactions. Contact your bank immediately and inform them about the suspected fraudulent activity. They can help stop further transfers or reverse recent ones if possible.

- Have Careful Hiring Practices: Employing a checks-and-balances workflow can help spot individuals who have the potential to commit fraud against your financial institution. The goal is to eliminate the threat before any inside fraudulent transactions can occur.

- Educate Your Employees About Phishing Schemes And Identity Theft: Your employees should be aware of common scams like phishing schemes, where fraudsters seek sensitive information through deceptive emails or websites designed to steal bank account passwords or personal data. Promote good password habits among staff members – changing them frequently, not sharing them with others, etc.

If you become a victim despite these precautions, report it immediately, either directly to the FBI’s Internet Crime Complaint Center or contact law enforcement agencies who handle cases involving complex ACH fraud.

Remember – prevention is always better than cure. Following these best practices will significantly reduce the risk of processing electronic payments.

Conclusion

In conclusion, while ACH processing provides benefits for your business, ACH fraud is a serious issue that should not be taken lightly. Businesses must remain vigilant and take proactive measures to protect their financial information from falling into the wrong hands.

By understanding the risks associated with ACH fraud and implementing the right protective measures, businesses can greatly reduce their risk of becoming victims of this type of crime.