Are you on the hunt for a payment processor that fits your business needs? Looking for a processor can be tricky, but I’ve got the inside scoop. With my experience working at a payment processor, I know exactly which features will help your business run smoothly.

In this guide, I’ll walk you through the top features to look for. We’ll cover everything from strong security that keeps your customers’ information safe to payment flexibility to keep your customers happy. I’m here to make choosing the right processor simple, so you can get back to growing your business.

Let’s spotlight the features that matter most for your shop or online store.

TL,DR

Payment processor features can be broken down into the following categories:

This site is supported by its readers. If you purchase through a link on my site, I may earn a commission. For more information see my Disclosure Policy

What Are the Best Features That Every Payment Processor Should Have?

Security and Compliance

1.) Protect Your Customers with Advanced Payment Security

In today’s digital age, robust security features are non-negotiable for any payment processor. It’s not just about checking a box; it’s about being secure as possible for your customer’s sensitive payment details. When I worked at a processor, part of my job was ensuring payment security for our clients. We took this seriously because we realized how important this was for their customers.

With high-profile data breaches making headlines, it’s critical to choose a processor that offers ironclad security measures. Look for encryption of transaction and cardholder data as a standard practice for online payments.

A commitment to secure payments means you can assure your customers that their information is protected, fostering trust and loyalty to your brand.

2.) Stay Safe and Sound with a Compliant Payment Processor

Payment processors should ensure that they are compliant with the pertinent laws and regulations of their respective countries.

Your processor must play by the rules. This means they follow all the laws and regulations that apply to them. When they’re compliant, you know they’re serious about doing things right. This keeps you and your customers safe from legal troubles.

3.) Protect Customer Card Data by Meeting Data Security Standards

For any processor, adhering to the Payment Card Industry Data Security Standard (PCI DSS) isn’t optional—it’s essential. This set of guidelines ensures that your customers’ card information is handled with the highest security standards. When your payment processor is PCI DSS compliant, it means they’re serious about protecting payment data.

Plus, when they handle and store your sensitive customer information, your business won’t have to — relieving you of this compliance burden.

4.) Secure Customer Data with Tokenization: Your Businesses Shield

Imagine giving your customer’s payment information a secret identity. That’s what tokenization does.

It swaps out sensitive details, like credit card numbers, for a unique code called a token. This means the real data is locked away safely and only the token moves around the system. It’s like having a special passcode that keeps your customer’s info safe.

5.) Spot and Stop Payment Scams with Advanced Fraud Detection

Think of fraud detection as your business’s own security guard. It’s all about spotting the bad guys—those sneaky fraudulent transactions. Sometimes it’s as simple as making sure the name and signature match the card. Other times, it’s about checking the little code on the back or the billing address for address verification mismatch.

But the real magic happens with high-tech tools that use smart analytics to catch fraudsters in the act. AI systems can detect fraud now in real-time, saving you from having to deal with the problems after they occurred.

6.) Activate Enhanced Protection with 3D Secure Verification

Have you ever made a purchase using a credit card, but before you complete the process, you were contacted (by phone, text, or email) by your card issuer about the purchase? This is an example of a processor using a verification method called 3D Secure.

You can add an extra layer of defense to your transactions with this protection feature. This feature asks customers to verify their identity directly with the card issuer during payment. It is an extra checkpoint that ensures the person making the payment is the rightful card owner.

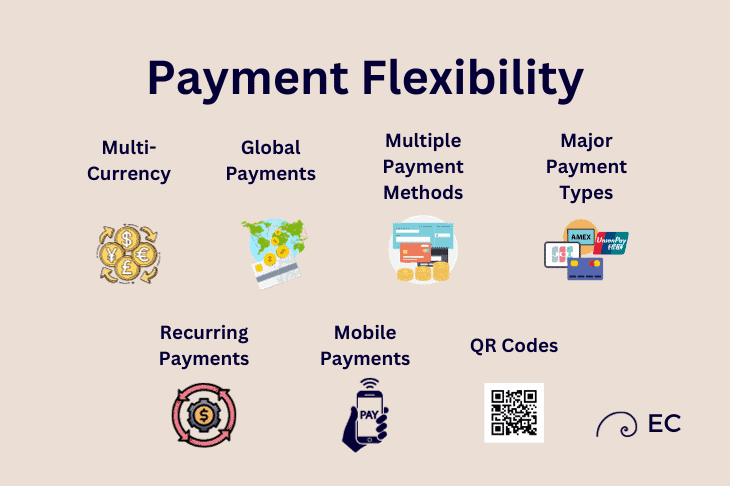

Payment Flexibility

7.) Capture Worldwide Sales with Multi-Currency Payment Processing

Make every customer feel at home on your site with multi-currency payment processing. This feature lets shoppers pay in their own currency, while your processor takes care of the currency conversion. It’s a smooth way to build a global customer base.

8.) Expand Your Reach with Global Payment Acceptance

Embrace the world market by choosing a processor that handles international payments. This feature is key for businesses aiming to grow globally, allowing you to welcome customers from any corner of the world.

9.) Boost Checkout Flexibility with Multiple Payments Methods

Give your customers the convenience they deserve by offering a wide range of payment methods. Whether they prefer using credit cards, ACH (eCheck), digital wallets, or mobile payments, your processor should support them all. This inclusivity not only meets customer expectations but also opens the door to a broader audience.

10.) Welcome All Customers with Support for Major Payment Types

Make sure your processor accepts all the big card brands: Visa, MasterCard, Discover, American Express, China Union Pay, and JCB. This inclusivity is key to not turning away customers just because of their preferred payment type.

11.) Automate Sales with Recurring Payments

A processor that lets you set up recurring payments can save you a lot of time. This means sales can happen on their own, again and again, without you having to do anything each time. It’s great for things like subscriptions or monthly services.

12.) Keep Up with Customers Using Mobile Payments

Mobile payments are a must-have for processors today. They let your customers pay easily with their phones using Google Pay™, Samsung Pay™, and Apple Pay™. This is great because more people like to pay with their phones now. It’s fast and they don’t need to carry cards. They also don’t need to touch the POS terminal, so it is truly contactless.

13.) Simplify Payments with QR Codes

QR codes from your processor can make paying easy. They work for buying things in stores or online. When customers scan the code with their phone, it takes them right to where they can pay. They essentially have a POS (point of sales) terminal in their pocket.

User Experience

14.) Speed Up Sales with a Simple Checkout ‘Buy Now’ Button

A ‘Buy Now’ button from your payment processor can make shopping super quick for your customers. It’s a one-click way for them to buy what they want without any hassle. This simple checkout button can make a big difference in how many sales you make.

15.) Simplify Sales with an Integrated Payment Page

Choose a payment processor that gives you an integrated payment page. It’s a page they set up for you to take payments, which makes your job easier. You won’t have to spend a lot of time setting up or fixing things. It also means your customers have a smooth time buying from you.

16.) Keeping Your Brand Front and Center with a Hosted Payment Page

A hosted payment page is a special page for your customers to pay on, and it looks like the rest of your website. This is good because it has your business’s style and logo on it, which can make customers feel more at home when they pay.

An integrated payment page is a part of your website where customers can pay without feeling like they’ve left your site. It’s built to fit right into your website’s design.

A hosted payment page, on the other hand, is a payment page that the processor creates and hosts for you. It can be customized to match your brand, so when customers go to pay, they still feel like they’re dealing with your business, even though the page is actually on the processor’s system.

Both options are to make the payment process smooth, but the main difference is where the page lives and how much it feels like a part of your site.

17.) Take Payments Anywhere with a Virtual Terminal

A virtual terminal is like a portable cash register you can use from any device that’s online. It’s perfect for when you need to take payments in person or on the go.

With this, you can turn your computer, tablet, or phone into a payment-taking machine. This means you can accept payments anytime, anywhere, making it super flexible for your business.

And the best part? You don’t need a point-of-sale terminal or a card reader to accept credit cards!

18.) Connect Seamlessly with Shopping Cart Integration

Your payment processor should work well with different shopping carts like Shopify, WooCommerce, and Magento. This helps you get payments through your website smoothly. It’s all about making things easier for you and your customers when they check out. And the easier it is for customers to check out, the higher your conversions will be.

19.) Customize Your Payment Process with API Access

API access means your business can talk directly to the processor from your own system. This gives you the power to build a payment process that’s just right for your customers. You can create custom tools to make sure your checkout works the way you want.

20.) Expand Your Options with Multiple Payment Gateways

Give your business the flexibility it needs with a processor that offers multiple gateways. This isn’t just about having options — it’s about finding the perfect fit for your unique business needs.

Whether it’s catering to customer preferences, reducing transaction fees, or ensuring uptime, each gateway offers distinct advantages. More gateways mean you can tailor your payment processing to match the way you do business. This provides a seamless experience for your customers and a reliable, cost-effective solution for you.

21.) Make Repeat Shopping Easy with Customer Information Management

A payment processor with customer information management keeps your regular customers’ details safe. So, when they come back to buy more, they don’t have to fill out their information again. This makes shopping faster and easier for them, and they’re more likely to keep coming back.

Operational Efficiency

22.) Save Time with Automatic Payment Processing

Automatic payment processing lets you handle sales fast and without much work. It’s a big help for any business because it does the payment work for you. This means you spend less time on paperwork and more on what you love. Plus, it helps avoid mistakes. And your customers? They’re happy with the quick service you give them.

23.) Get Started Fast with Easy Payment Processor Integration

Your processor should be easy to set up. This means you can start taking online payments quickly. Easy integration saves you time and lets you sell right away. This can make your business run better from the start.

24.) Keeps Sales Swift with Fast Transaction Processing

Speed is key when customers are ready to buy. Fast transaction processing not only keeps the checkout line moving but also makes online shopping a breeze. It’s about giving your customers a smooth, wait-free experience that leaves a good impression. When payments are processed quickly, it means less time staring at loading screens and more time enjoying their purchase.

25.) Track Your Success with Detailed Reporting

Having detailed reports is a big help. It lets you see all sorts of information about your sales. This way, you can know what’s working well and what you might need to change. Understanding your business better can help you make smart decisions.

26.) Speed Up Payments with Easy Invoicing Options

It should be simple to send invoices. This helps you get paid without any trouble. When you can invoice easily, it means less waiting for your money. Having invoicing options can make a big difference in how fast you get paid and keep your cash flow healthy.

27.) Handle Big Sales Easily with Batch Processing

Batch processing means your payment processor can take a lot of sales at once and handle them together. This is helpful for when you have many transactions that you want to go through at the same time.

28.) Stay Updated Instantly with Webhooks

Webhooks in your payment system mean you get updates the moment a sale happens. This real-time info keeps you in the know about your money. An example would be getting a text when a customer pays. Webhooks are great for keeping track of your transactions as they happen.

29.) Save Money with Smart Transaction Routing

With transaction routing, you can choose the best path for your sales to go through. This can be through different gateways or acquiring banks. Think of it like picking the quickest checkout line so you can save time and money. This can cut costs and make payment processing smoother for your business.

Costs Efficiency

30.) Understand Your Costs with a Clear Fee Structure

Knowing exactly what you’re paying for with your processor is super important. They should tell you about all the fees upfront, with no surprises later on. A clear fee structure means you can plan your budget better and avoid any unexpected charges.

31.) Cut Costs with Level 3 Processing

Level 3 processing is a special way to handle payments where you give more details about each sale, like item descriptions and quantities. It’s a bit more work, but it can save you money if you take a lot of payments from cards that can use Level 3.

It’s different from Level 1 and Level 2 because those don’t need as much info about the sale. Level I is the basic kind, good for everyday sales. Level II adds a bit more detail for businesses. Level 3 goes even further, perfect for big sales where the details matter.

Support, Reliability, and Scalability

32.) Get Help Anytime with 24/7 Support

It’s important that your processor is there for you all the time, day or night. If something goes wrong, you need to get help right away. 24/7 support means someone is always ready to answer your questions or fix issues, so you can keep your business running smoothly.

33.) Grow Your Business with Reliable and Scalable Payment Processing

A good payment processor should always be ready and able to handle your sales, even as your business gets bigger. You should never have to worry if it can keep up with more and more sales. This kind of processor grows with you, making sure that no matter how busy you get, every payment goes through smoothly.

Merchant Services

34.) Streamline Your Sales with a Dedicated Merchant Account

Open the door to easy payments with a Merchant Account. This special type of bank account is designed for businesses to accept credit and debit card payments smoothly. It’s a must-have for any business looking to streamline their sales process.

35.) Keep Business Running with Accepting High-Risk Transactions

If your business is in a high-risk industry, you accept high-risk transactions, or your credit isn’t perfect, your processor needs to accept high-risk transactions. It means you can still make sales and keep your business going strong.

What does a payment processor do?

Whichever processor you use will essentially act as the middleman between your business and your customer’s bank. The processor will process the payment and then deposit the funds into your merchant account. Your customer’s bank may also hold onto a small portion of the funds (known as a reserve) to protect against any potential chargebacks that may occur.

What are payment processor examples?

There are many processors available, including Square, Stripe, PaymentCloud, Clover POS, and Dharma Merchant Services.

Conclusion

A payment processor is a vital part of any business that accepts payments, and it is important to choose a good one. The processor will act as the middleman between your business and your customer’s bank and will process the payment and deposit the funds into your merchant account.

Remember, the goal is to choose a payment processor that not only meets your current needs but also grows with your business. Whether you’re a small startup or a growing enterprise, these features are the tools that will help you build a secure, efficient, and customer-friendly payment ecosystem.